Why The Collective

A first-of-its-kind collective of small business owners, pooling power to secure better funding -

Small Businesses, United.

We aren’t waiting for a seat at the table. We’re building our own — together.

Going at It Alone Is Expensive

Traditional lenders deny over 80% of small business loan applications. And the "alternatives"? Often predatory, short-term, and stacked with fees.

This isn't about bad businesses. It's about bad leverage.

MiltonHaines is organizing 10,000+ small businesses to apply for funding together — so we can negotiate like a franchise, not beg like a startup.

What You Get — And Why It's Free

We give you a professional WordPress website and a LocalEdge Blueprint for one reason: a stronger business means a stronger collective. This isn't a handout — it's strategy.

A professionally built website (yours to keep)

Ongoing site updates & security

Your website builds trust with lenders

A free market analysis + custom marketing plan

Option to delay payments if funded

Your blueprint improves cash flow & growth

Collective-only funding rates

Invite-only access to lender partners

Your results increase our group negotiating power

Who This Is For

✓ Businesses denied by banks

✓ Startups trying to get lender-ready

✓ Anyone who would benefit from a free marketing plan and website

✓ Owners paying too much on fast-cash funding

✓ Businesses without modern websites, locked out due to cost or tech barriers

✓ Those tired of navigating this system alone

Why Now?

We're launching with our first 10,000 members. The more we grow, the stronger our bargaining power becomes — and the more benefits we unlock for our members.

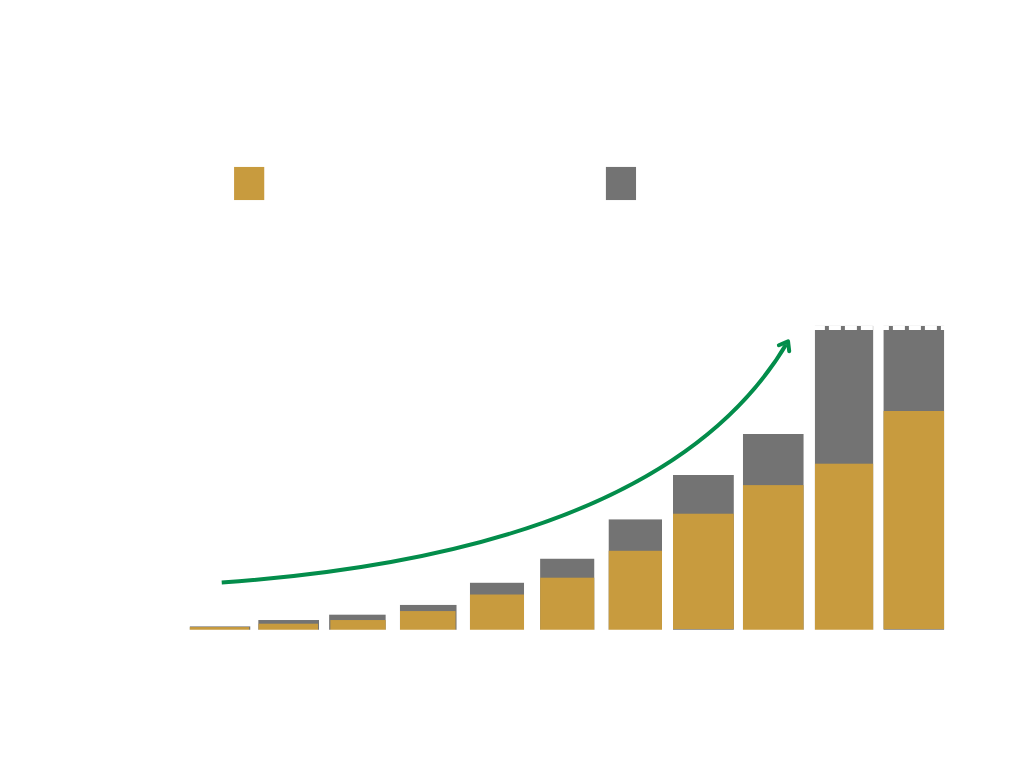

Revenue-Based Finance Industry Expected to Grow 28x in 7 Years

The revenue-based financing market is exploding, with projections showing an increase from $6.4 billion to $178.3 billion by 2033. This rapid expansion reflects a shift in how small and medium-sized businesses (SMEs) raise capital.